The Travel Market in 2023: Lingering Cost-of-Living Effects, or Long-Term Return to Normal?

Nano Interactive wrote last summer on the latest travel industry trends, and how they were informing activation and online advertising tactics. At that point, it was still very much a question of whether the industry would rebound fully from Covid. Nine months on seems to be a good point to review where we stand again, looking into both external research and internal insights from the billions of intent signals Nano responds to each week.

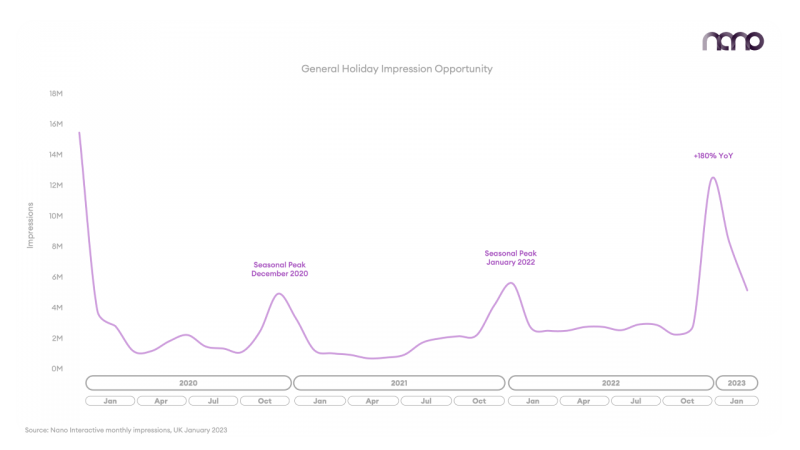

There are reports of record summer holiday bookings right now, but if the market has fully rebounded, how has it also responded, with cost-of-living pressures unlikely to disappear anytime soon? We need to fully understand what has changed, as well as what’s the same in order to succeed. Here are some of our top findings:

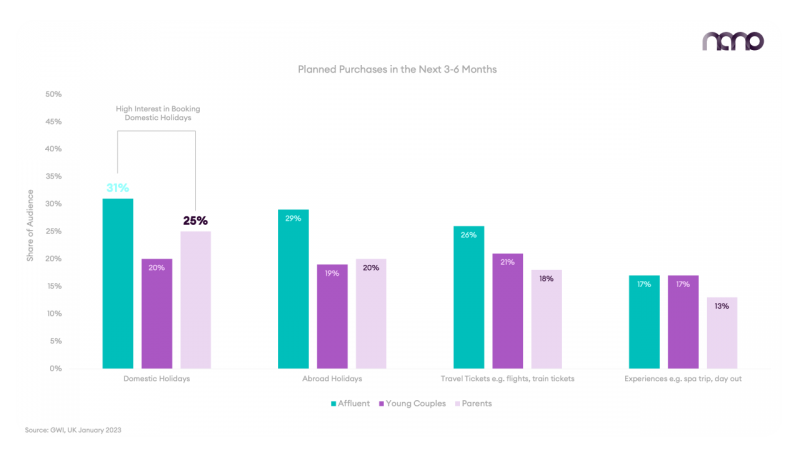

Despite economic pressures, when it comes to families at least, our research suggests holidays are a non-negotiable purchase. While they might be cutting back completely in other areas, that is not the case with travel.

That said, for obvious reasons, affordability is now a top concern: parents spend £250-£500 per person on tickets according to our research. It may therefore be the case that, while we are not necessarily reducing the number of holidays we have, instead the distance we choose to travel is diminishing to manage costs.

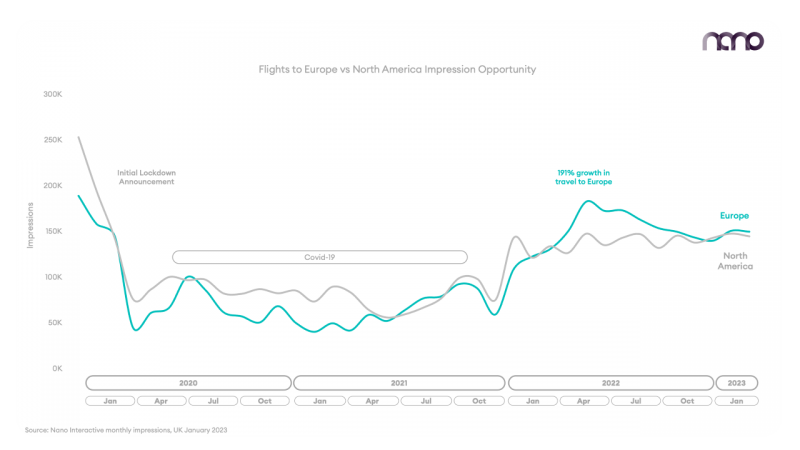

This may explain why in part, as the below chart shows, intent around flights to Europe has recovered faster than for North America:

There is also perhaps the suggestion here that the widely reported delays and extra queues experienced in air travel since Covid have affected peoples’ travel destination choices.

The above graph would support this idea perhaps, but even more so the fact that we see 30% of affluent travelers in the UK are more likely to book an international short-haul flight holiday once a year rather than a long-haul one. That is, among the group we might most expect to still be able to afford more distant destinations, many are also looking closer to home.

For similar reasons, it’s probably not a great surprise that domestic holidays are still the most popular choice for parents. But we can also add to the mix the fact that travel abroad can bring a fear of the unknown, perhaps more so for those who haven’t done so due to restrictions over the past few years: our research also suggests that parents consider safety as one of the top three most important factors when planning holidays.

Even as Summer holiday bookings have bounced back to above pre-2020 levels, travel seems a changed landscape. Just as online advertising has changed – and is changing still – with the loss of cookies and other people-based targeting signals. But just as above we have highlighted updates on what the ‘new normal’ for travel now is starting to look like, there is also a growing understanding around intent and contextual targeting, which avoids the limits on audience reach we would otherwise be facing.

Contact them today to learn more about Nano Interactive's services.

Want more like this?

Want more like this?

Insight delivered to your inbox

Keep up to date with our free email. Hand picked whitepapers and posts from our blog, as well as exclusive videos and webinar invitations keep our Users one step ahead.

By clicking 'SIGN UP', you agree to our Terms of Use and Privacy Policy

By clicking 'SIGN UP', you agree to our Terms of Use and Privacy Policy

Other content you may be interested in

Categories

Categories

Categories

Categories

Want more like this?

Want more like this?

Insight delivered to your inbox

Keep up to date with our free email. Hand picked whitepapers and posts from our blog, as well as exclusive videos and webinar invitations keep our Users one step ahead.

By clicking 'SIGN UP', you agree to our Terms of Use and Privacy Policy