Demand for Financial Products Soars by 30% According to Nano Data

With UK interest rates continuing to rise, reaching their highest level for 15 years, new data from Nano Interactive reveals rising consumer demand for financial products and services that can help them through the cost-of-living crisis.

The analysis of billions of pieces of content reveals that interest in content around cost-of-living soared by 221% rise in 2022, with the sharpest growth occurring from October 2022 to January 2023.

Overall demand for financial products in the past year has also increased by 30%, driven by bank accounts (147%), borrowing (48%) and insurance (23%)However, consumers are focusing less on long-term savings with demand for wealth products (investing, ISAs) dropping by 21%.

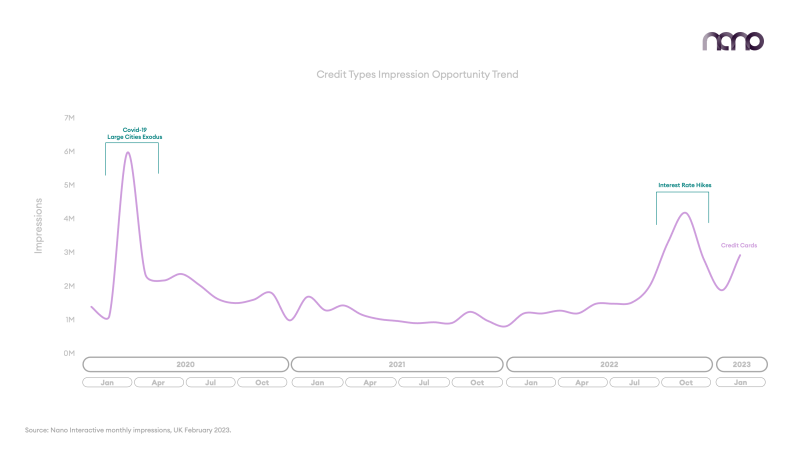

The number of people engaging with content around mortgages grew 192% from Q4 2021 to Q4 2022, the largest of any category. While demand for loans and credit cards remained stable over this period, there was a noticeable spike in January 2023 as more people researched credit options at the start of the year.

Content around ethical banking has also been on the decline since the start of 2021 but this trend has accelerated in recent months by the cost-of-living crisis, war in Ukraine and rising interest rates.

Artiom Enkov, Head of Insights & Analytics at Nano Interactive shares his advice for financial services brands looking to reach the right consumers with the right products at the right time:

“Consumer behaviour and sentiment is changing fast as the cost-of-living crisis evolves, so it’s important for brands and advertisers to stay agile when allocating spend to campaigns and consider tailoring creative accordingly.

“For example, with demand for borrowing and insurance products high, consider targeting content relating to specific credit types, with tailored creative based on product type displaying unique brand USPs.

“While there is a huge opportunity to tap into interest around cost-of-living, this content is generally negative with the most recent articles referencing nationwide shortages of vegetables or interest rate rises. Make sure to protect brand activity by only targeting content with positive or neutral sentiment or tap into content that mentions competitor products with a negative sentiment. It’s also important to be helpful, by choosing creative linked to ways to save money alongside relevant content.”

Contact them today to learn more about Nano Interactive's services.

Want more like this?

Want more like this?

Insight delivered to your inbox

Keep up to date with our free email. Hand picked whitepapers and posts from our blog, as well as exclusive videos and webinar invitations keep our Users one step ahead.

By clicking 'SIGN UP', you agree to our Terms of Use and Privacy Policy

By clicking 'SIGN UP', you agree to our Terms of Use and Privacy Policy

Other content you may be interested in

Categories

Categories

Categories

Categories

Want more like this?

Want more like this?

Insight delivered to your inbox

Keep up to date with our free email. Hand picked whitepapers and posts from our blog, as well as exclusive videos and webinar invitations keep our Users one step ahead.

By clicking 'SIGN UP', you agree to our Terms of Use and Privacy Policy